最近的事件表明,港澳和內地執法部門在持續打擊三地不斷變化的新型洗黑錢活動,並取得成功。

犯罪集團利用網絡情緣進行詐騙

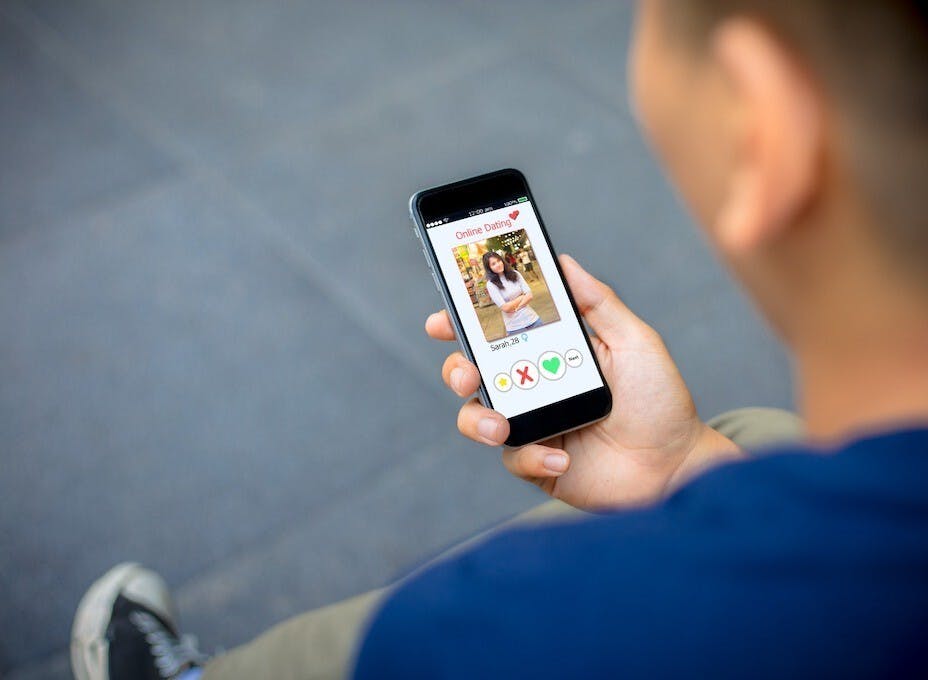

7月26日至28日,香港警方拘捕了24名涉嫌參與洗黑錢活動的家庭傭工,其中包括兩名尼日利亞籍主腦、3名骨幹成員和24名外傭。被捕者年齡介乎29至51歲,他們將35個銀行賬戶借給犯罪集團,以清洗2700萬港元犯罪得益。令人震驚的是,有一半洗黑錢活動涉及20宗男女尋找戀愛對象的網絡詐騙案,還涉及兩宗電郵詐騙案。警方發現,該犯罪集團以港幣1000元至數千元,引誘外傭將個人銀行賬戶借出,用於詐騙案件中的資金轉移。

在一宗網絡詐騙案中,一名46歲秘書被騙168萬港元,受害人成為使用手機和應用程式的疑犯的目標。在打擊洗黑錢行動中,警方查獲100張銀行提款卡、點鈔機和現金33萬港元。這次行動最突出的特點是,打擊了一個結合網絡詐騙和洗黑錢活動的犯罪集團。

有跡象表明,犯罪分子利用網絡跨境詐騙渴望愛情的男女。6月中旬至7月7日,港澳警方破獲兩個犯罪集團,涉嫌10宗詐騙男女案件,涉案金額達2000萬港元。3名41至47歲的男女集團主腦被捕。據悉3人是銀行賬戶持有人,他們涉嫌協助犯罪集團清洗從香港和澳門賺來的黑錢。 同時,澳門警方亦拘捕兩男兩女,其中包括一名男性主腦,涉嫌參與7宗詐騙及洗黑錢案件,涉款約150萬澳門元。

兩個犯罪集團的詐騙模式是一模一樣的──不法分子利用應用程式「釣魚」,結交潛在目標,並將「朋友關係」發展成「愛情關係」。之後,不法分子以缺錢應付醫藥費、訛稱受騙要求幫助償還個人債務、引誘受害人投資等各種藉口,欺騙目標對象。儘管港澳警方經常呼籲市民警惕網絡詐騙,但仍有不少受害人上當──證據顯示,很多受害人落入愛情騙子的網絡詐騙陷阱時,情感遠勝於理智。

2021年5月,香港警方拘捕了11名涉嫌在愛情騙局中進行詐騙的疑犯。 包括外國人的15名受害者共損失830萬港元,其中一宗詐騙案受害人就損失了230萬港元。 所有案件均採用電話詐騙,警方沒收該犯罪集團的資產達2400萬港元。拘捕了6男5女,其中包括一些開設銀行賬戶並將之出售給犯罪集團的人。與其他愛情騙局一樣,犯罪集團利用互聯網騙人借出銀行賬戶。

洗黑錢活動增加,內地收緊資金管制

2020 年初的新冠疫情令跨境洗黑錢變得困難。洗黑錢活動通常不僅在港澳和大陸三地大量往來的人流之間進行,且會通過澳門眾多的賭場和找換店進行。更有甚者,澳門與珠海跨境往來容易,也會讓洗黑錢活動有機可乘。

然而,自2020年以來,內地一直收緊從內地流向港澳的資金流,包括監控所有可能被用作洗黑錢活動渠道的貨幣找換店、對港澳的貨幣兌換商實行更嚴格的登記制度,反映了內地當局對貨幣找換店及其向內地匯款的控制相應加強。

也許內地所有這些舉動都不令人感到驚奇,尤其是有一些報道指出,特區政府 2019 年中提出修訂《逃犯條例》,實質上也針對約 300 名在香港洗黑錢的內地商人和貪腐幹部。

2020年11月,澳門政府加強了政府間打擊洗黑錢活動的跨部門協調,成立跨部門專項小組,加強打擊洗黑錢活動的情報交流。那些攜帶大量現金過境澳門的旅客,將需接受更嚴格的檢查。

2021年6月,北京、河北、山西、遼寧等地警方對170個利用網絡平台詐騙民眾、利用加密貨幣和虛擬貨幣從事洗錢活動的犯罪團伙進行了大規模打擊。這些犯罪團伙都利用個人銀行卡在互聯網貨幣兌換平台註冊,欺騙目標受害者,最後利用加密貨幣和虛擬貨幣洗黑錢。他們把 1% 到 5% 佣金付給幫助洗黑錢的人。鑑於內地電子交易的便利性,犯罪分子一直在利用虛擬貨幣和銀行賬戶進行高度隱蔽的洗黑錢活動。

洗錢活動形式多變,三地警方加強查緝

鑑於洗錢手段日趨複雜,2021年1月,中國人民銀行與內地反洗錢處官員,香港警方反洗黑錢情報人員及澳門金融情報辦公室人員召開視像會議,就如何落實大灣區反洗錢情報交流機制的工作交換意見。鑑於新冠疫情逐漸受控,港澳及大灣區內城市的洗錢活動可能會增加,因此有必要令此類會議常態化和制度化。

綜上所述,香港、澳門和內地的洗錢活動呈現變化和新格局。香港仍然存在網絡欺詐及利用銀行賬戶進行洗黑錢活動的愛情騙局;澳門則在賭場營業額下滑的情況下,嚴厲打擊洗錢活動。另一方面,內地當局設想不法分子暗中透過電子交易和虛擬貨幣進行洗錢活動。

新冠疫情預計可能在一年後逐漸消失,香港、澳門和內地的執法機關和官員,仍然必須就洗錢活動模式的改變加強情報共享,使三地在國家安全和經濟安全等方面在經濟緩慢復甦中得到保障。

Crackdown on new types of money laundering in Hong Kong, Macau and Mainland

Recent events have pointed to a persistent phenomenon of successful efforts made by law-enforcement agencies in Hong Kong, Macau and the mainland to crack down on the changing and new patterns of money laundering in the three places.

From July 26 to 28, the Hong Kong police arrested 24 domestic helpers involved in money laundering activities, including two Nigerians and three other foreigners. The arrested suspects ranged from 29 to 51 years old, and they lent 35 of their bank accounts to criminal syndicates for laundering a huge amount of money worth HK$27 million. Shockingly, half of the amount of money laundering activities embraced not only 20 cases of deception through the Internet which targeted at men and women searching for lovers, but also two cases of email deception. The police discovered that the criminal syndicate used HK$1,000 to several thousand dollars to seduce each domestic helper to lend out his or her personal bank accounts, which were used for transferal of money in the cheating cases. In one case of Internet deception, a 46-year-old secretary was cheated for HK$1.68 million and the victim became the target of criminal elements using I-phone and apps. In the anti-money laundering crackdown, the police uncovered 100 bank cards, money-counting machines and cash that amounted to HK$330,000. The most prominent feature of this crackdown was the mixture of Internet deception and money-laundering activities.

There were signs that Internet deception targeting at men and women hungry for love spread across the boundaries of Hong Kong and Macau. From mid-June to July 7, the police from Hong Kong and Macau smashed two criminal gangs that were involved in cheating men and women in ten cases amounting to HK$20 million. Three ring leaders were arrested – a 43-year-old Hong Kong man and two women aged 47 and 41 years old – for being bank account holders who assisted the criminal syndicates to launder dirty money earned from Hong Kong and Macau. At the same time, the Macau police arrested two men and two women, including a male ringleader, for being involved in seven cases of deception and money laundering that amounted to MOP1.5 million.

The pattern of deception of the two criminal organizations was the same: criminal elements conducted “fishing” through apps to make friends with potential targets and to develop such friendship to “love.” Then these criminal elements used all kinds of excuses, such as lacking money to deal with medical expenses, pretending to be victims of deception and requiring help to pay personal debts, and luring victims to make investment, to deceive the targeted persons. Although the police in Hong Kong and Macau often appeal to residents for the need to be vigilant over Internet deception, still there were many cases of victims being cheated – an evidence showing that many victims were far more emotional than rational in falling into the trap of love deception.

In May 2021, the Hong Kong police arrested 11 people who were allegedly involved in the deception of 15 victims in love scams. The 15 victims, including foreigners, lost a total of HK$8.3 million in which a single case of deception cost HK$2.3 million. All the cases used telephone deception and the police confiscated the criminal syndicate’s asset that amounted to HK$24 million. The police arrested six men and five women, including some people who opened bank accounts and sold these accounts to criminal organization. As with other love scams, the criminal syndicate used the Internet to cheat people to lend their bank accounts.

The onset of Covid-19 in early 2020 brought about the difficulties of money-laundering activities, which were traditionally conducted through not only the voluminous human traffic between Macau and the mainland, and between Macau and Hong Kong, but also the numerous casinos and money changers in Macau. Yet, the relaxation in the border between Macau and Zhuhai appeared to revive the opportunities for money laundering activities.

However, mainland China has been tightening money flows from the mainland to Macau and Hong Kong since 2020, including the surveillance on all money changers which might be used as a conduit for money laundering activities. A more rigorous registration system was implemented in the money changers of Hong Kong and Macau, reflecting a correspondingly tighter control by the mainland authorities over money changers and their remittance of money to the mainland. Perhaps all these mainland moves were unsurprising, especially in light of some reports that the extradition bill initiated by the Hong Kong government in mid-2019 was actually targeting also at some 300 mainland businesspeople and corrupt cadres who laundered their dirty money heavy in Hong Kong.

In October 2020, the Chinese Criminal Law was in the process of revision, expanding the legal liability to those casino employees outside the mainland who went into to China to market casino customers and gamblers. In December, the revision to the Criminal Law was approved by the Standing Committee of the National People’s Congress, affecting the marketing agents from Macau’s casinos who might try to go into the mainland to mobilize mainland customers to gamble in Macau. Some Macau observers regarded the revision of the Criminal Law as a blow to the marketing agents of Macau’s casinos.

However, it appeared that the revision aims at not only Macau, but also many other places outside China that have casinos, including Cambodia, Vietnam, the Philippines, Russia and Australia, where mainland Chinese tourists in the past liked to gamble there. Many observers have apparently neglected the fact that the definition of national security in mainland China had long been broadened to encompass economic security, namely the prevention of money laundering activities through “legal” and “illegal” means. Casinos legally exist in Macau, but money laundering activities are deemed to be threatening the national security of the mainland. As such, the revision of the Criminal Law in late 2020 was in full conformity with the protection of China’s national security.

During the persistence of Covid-19, e-transactions have been facilitating money laundering and the government of Macau responds to it by enhancing anti-money laundering capabilities. In June 2021, the Macau Monetary Authority (MMA), the Macau Gaming Inspection and Coordination Bureau (GICB), and two anti-money laundering associations organized an anti-money laundering conference that attracted the participation of 200 elites from the banking sector, insurance industry, gaming sector and the hotel industry. The theme of the conference was that, as technology developed quickly amid Covid-19, criminal elements grasped the available opportunities to engage in money-laundering activities. As such, the Macau Monetary Authority placed its emphasis on risks management and assisted the professional sectors to combat money laundering. The Monetary Intelligence Office of the Macau government in 2020 formulated the second five-year plan to fight money laundering, including terrorist financing and the setting of short-term, medium and long-term targets. While the government has the will to fight money laundering, it remains to be seen how it will do so effectively.

In November 2020, the Macau government strengthened intergovernmental department coordination in the combat against money laundering, The Monetary Intelligence Office, the Judicial Police, the MMA and GICB set up a cross-departmental project group to enhance communications in the combat against money-laundering activities. Travelers who bring a huge amount of cash across the border of Macau are subject to closer investigation.

While there have been discussions on the need for Macau to build up its securities market, it remains a challenge for the law-enforcement authorities to ensure that such a market would not constitute another conduit for criminal elements to launder dirty money. If the securities market relies on mainland investment, the origins of the mainland investment would be eventually under the scrutiny of law-enforcement authorities in the mainland and Macau.

In April 2021, an international deception organization was suspected of utilizing some people to set up an empty shell company in Macau. This shell company was said to receive the “deception money” from two Australian companies that were hacked. Three persons in Macau were arrested and an amount of HK$8.9 million was confiscated from the shell company’s account. Apparently, cross-border money laundering was involved in this case with the entanglement of Macau Chinese and Australian.

The tighter control over money laundering in Macau was said to affect Taiwan, where some politicians had been reportedly using Macau as a channel for their money-laundering activities. It was reported in Taiwan in October 2020 that some leaders of the Democratic Progressive Party (DPP) had been allegedly involved in money-laundering activities in Macau during the campaign of the 2012 presidential elections on the island (New News Magazine, October 13, 2020).

As Taiwan’s relations with Macau and Hong Kong have deteriorated, such cross-border money-laundering activities have appeared to decline. But if Covid-19 gradually fades away later, cross-border money laundering involving Taiwan politicians in Macau would have the likelihood of revival.

In June 2021, the mainland police in Beijing, Hebei, Shanxi and Liaoning conducted a large-scale crackdown of 170 criminal syndicates that cheated ordinary people through Internet platforms and engaged in money-laundering activities through encrypted and virtual currencies. All these criminal organizations used personal bank cards to register in the money exchange platforms on the Internet, cheated the targeted victims, and finally utilized encrypted and virtual currencies to launder their dirty money. One to five percent of commission was paid to those who helped in the process of money laundering. Given the ease of e-transactions in the mainland, criminal elements have been making use of virtual currencies and bank accounts to conduct money laundering in a highly hidden manner.

In view of the increasing sophisticated methods of money laundering, the People’s Bank of China, the mainland’s anti-money laundering officials and their anti-money laundering counterparts in Macau and Hong Kong held a video conference in January 2021, exchanging ideas on how to implement the intelligence exchange mechanism in their anti-money laundering work under the developmental blueprint of the Greater Bay Area. Given the likely increase in money-laundering activities in the Greater Bay Area and the mainland-Hong Kong-Macau region later when Covid-19 would gradually fade away, it is necessary that such talks will have to be regularized and institutionalized.

In conclusion, money-laundering activities show the changing and new patterns in the regions of Hong Kong, Macau and the mainland. Hong Kong has witnessed the persistence of love scams through Internet deception and the use of bank accounts to conduct money-laundering activities. Macau has seen a tight control on money-laundering activities amid the decline in casino operation and business. It remains to be seen how the new securities center, if established in Macau, will strike a balance between the achievement of economic prosperity and the control over money-laundering activities. On the other hand, the mainland has envisaged active money-laundering moves through e-transactions and virtual currencies secretly. In anticipation of the gradual fading away of Covid-19 perhaps one year later, it is still imperative for the law-enforcement agencies and officers in Hong Kong, Macau and the mainland to increase sharing their intelligence over the changing patterns of money-laundering activities so that the national and economic security of the three places will be safeguarded amid a slow process of economic revival.

原刊於澳門新聞通訊社(MNA)網站,本社獲作者授權轉載。