印尼總統佐科維多多2014年執政後提出「全球海洋支點」戰略(註1),五大支柱包括以印尼為中心與其他輻射區域合作,融入國際發展和對接相關需求,推動印尼取得今天的驕人成就。然而,長遠發展會否一帆風順?

印尼交易所強勢上榜

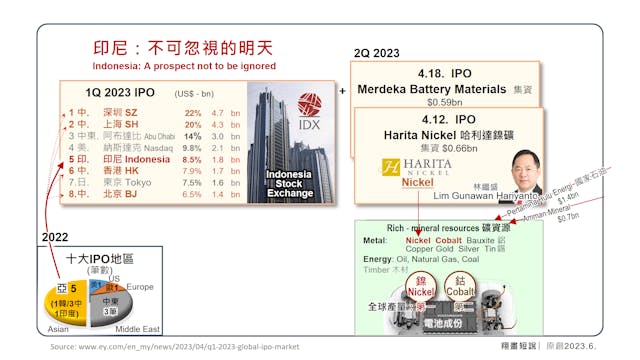

傳統的金融中心,前進力度已見乏力。去年十大IPO(首次公開募股)(註2),美歐各僅有一筆,其他都是亞洲。冒起的新星是中國和中東,它們包辦了大部分名次,是印尼這個海洋中心的輻射地。

再看今年首季的排名榜,印尼一鳴驚人,躍入五甲(註3)。分析因由,印尼助力東升西降!過往,投融資雙方彙聚金融中心,優點涵蓋政治穩定,資金自由進出。今天世局已變:

1. 信心:西方對中俄瘋狂制裁,已失可靠性;

2. 技能:上市的操作已非神秘,各地可仿效;

3. 盈利:企業所處環境具前景,魅力可投資。

企業在印尼當然是前景秀麗,資源大國在「全球海洋支點」戰略下,基礎設施大幅改善(第三支柱)。任期9年來,政府大量修建機場、港口、高速公路(註4),沒有這些長期投資,看看鄰國怎可高效對接「一帶一路」,貨運全球,賺取外匯。

印尼礦資源國際熱賣

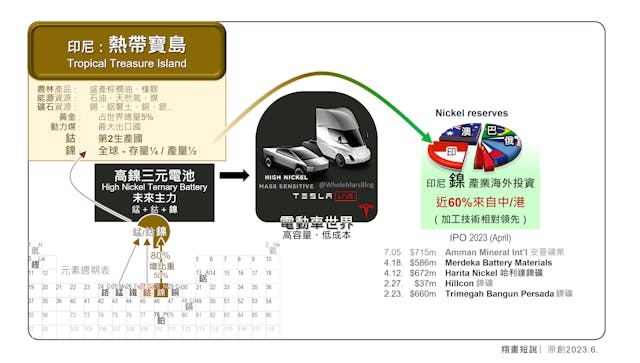

「熱帶寶島」印尼資源豐富,多類農產品屬全球十大,棕櫚油更是最大生產國;能源有石油、天然氣,動力煤是最大出口國;礦石種類多且重要,稀有金屬鎳礦和鈷礦的存量分列世上第一和第三,產量分別包辦冠、亞。

鎳、鈷和錳搖身一變成為現代新電池必須元素──高鎳三元電池(High Nickel Ternary Battery),鎳的比重更由50%增加至80%,這種電池發展正以每年11.1%速度增長(註5),高容量、輕重量、低成本,已成為環保電動車的重要組件。

印尼手執牛耳、點石成金。領導人聰明之處在於懂得吸引中資,利用其加工技術相對領先,強化產業魅力。企業擁有最好食材,廚房成為次要,金融中心就此逐步建立。印尼這座海中燈塔,向世界發出耀眼光芒。

總括而言,這屆政府貢獻有目共睹,經濟改善,民生受惠,但驕人成績總會惹來妒忌。世事無完美,從公開網頁可發現,以海外為基地的、打著人權和企業責任為口號的組織,以十多種語言渲染採礦業的缺點。這些顏色革命在國際上已被揭穿(註6),發展中國家的聯合聲明亦直指其非(註7)。未能遏止其滲透和破壞,投資者信心難鞏固,金融市場之路仍崎嶇。

註:

- 2013年10月習近平主席在訪問印尼提出了共建「21世紀海上絲綢之路」倡議,翌年的2014年6月印尼總統佐科宣誓就任後也提出了「全球海洋支點」戰略,五大支柱包括(一)提升海洋意識、(二)發展海洋經濟、(三)加強海上聯通、(四)推進海洋外交和(五)強化海上防務。

- 2022年十大IPO排名:1. 南韓($107億) 、2. 德國($87億)、3. 阿聯酋($61億)、4. 印度($27億)、5. 阿聯酋($20億)、6. 阿聯酋($18億)、7. 美國($17億)、8. 中國($16億)、9. 中國($16億)、10. 中國($16億)。

- 2023年十大IPO排名:1. 中國深圳($47億,22%)、2. 中國上海($43億,20%)、3. 阿布達比($30億,14%)、4. 美國納斯達克($21億,9.8%)、5. 印尼($18億,8.5%)、6. 中國香港($17億,7.9%)、7. 日本($16億,1.4%)、8. 中國北京($14億)、9. 意大利($13億)。

- 「維多多政府主持修建了16座機場、18個港口、38座水壩和近2000公里的高速公路。相比之下,在他上任前的40年裏,印尼總共只有約780公里的公路。」安邦智庫2022年10月25日的《每日經濟》,〈印尼的發展潛力值得重視〉

- “The High Nickel Ternary Battery market is expected to grow annually by 11.1% (CAGR 2023 – 2030)”, Market Watch, High Nickel Ternary Battery Market Research 2023-2030, 13 June 2023.

- 「報告披露美國中央情報局(CIA)在全球各地策劃組織實施大量「顏色革命」事件的主要技術手段,其中包括一款被稱為『蜂擁』的非傳統政權更迭技術,用於推動通過互聯網連接的年輕人加入「『一槍換一個地方』的流動性抗議活動」,中國國家電腦病毒應急處理中心(CVERC)發布《「駭客帝國」調查報告──美國中央情報局(CIA)》,2023年5月4日。

- 「各方一致認為,維護國家安全、政治穩定和憲法制度意義重大,堅決反對破壞合法政權和策動顏色革命」,《中國—中亞峰會西安宣言》2023年5月19日 。

Indonesia: A prospect not to be ignored

After Indonesian President Joko Widodo came to power in 2014, he proposed the Global Ocean Fulcrum strategy with five main pillars. One of which is cooperating with other radiating regions with Indonesia as the centre, integrating into international development and connecting with related needs, so as to achieve today’s remarkable achievements. However, will the long-term development be smooth sailing?

Indonesian Exchange Breaks into the Leaderboard

Progress in traditional financial centers has been lackluster. Of the top ten IPOs (initial public offerings) last year, aside from one in the US and one in Europe, the rest are all in Asia. The major new players – China and the Middle East – both radiate from Indonesia, the center of the ocean.

Looking at the ranking list in the first quarter of this year, Indonesia became a blockbuster and jumped into the top five. One of the main reasons for this is that Indonesia helps “the east rise and the west fall”. In the past, both investors and financiers took advantage of political stability and free capital movement to gather in financial centers. The world today has changed:

1. Trust: The West has crazily sanctioned China and Russia, losing reliability;

2. Skills: The listing operation is no longer mysterious and can be imitated everywhere;

3. Prosperity: The environment in which businesses operates is promising and attractive for investment.

The outlook for Indonesian enterprises is undoubtedly bright. Under the Global Ocean Fulcrum strategy, the infrastructure (third pillar) of resource-rich countries has been greatly improved. During the nine years of Jokowi’s administration, the government built a large number of airports, ports and highways. [Note 1] Without this kind of long-term investment, how can neighboring countries efficiently connect with the Belt and Road Initiative, transport goods to all parts of the world, and earn foreign exchange?

Indonesia’s mineral resources sell well internationally

Indonesia is a resource-rich “Tropical Treasure Island”. A variety of agricultural products rank among the top ten in the world, especially remarkable in its palm oil production. It supplies energy like oil and natural gas, and is the largest exporter of thermal coal. It is also rich in different important minerals. The supply of rare metal nickel ore and cobalt mine ranks first and third in the world, with their production ranking as the world’s first and second respectively, and the outputs are the champion and the runner-up respectively.

Nickel, cobalt, and manganese have been transformed into essential elements of a new type of modern battery – High Nickel Ternary Battery. The proportion of nickel has increased from 50% to 80%. This kind of battery, which is growing at an annual rate of 11.1% [Note 2], has a large capacity, is light weight and low cost, making it an important part of environmentally friendly electric vehicles.

Indonesia plays a leading role with power of Midas touch. The government is well aware of the advantages of attracting Chinese investment and using their relatively advanced processing technology to enhance the charm of its industry. Just like how a good meal does not require a sophisticated kitchen when the chef has the best ingredients in hand, Indonesia has its own advantages in becoming one of the world’s newly established financial centre. As a lighthouse on the sea, Indonesia shines bright light to the world.

All in all, the contributions of this term of government are obvious to all. The economy has improved and people’s livelihood has benefited, but impressive achievements will always arouse envy. Nothing is perfect in the world. Overseas organizations, with slogans of human rights and corporate responsibility, exaggerate the disadvantages of the mining industry, and such messages can be found on public websites in more than ten languages. These colour revolutions have been debunked internationally [Note 3], and some joint statements by developing countries also pointed to its plot [Note 4]. If its infiltration and destruction cannot be contained, it is difficult to consolidate investor confidence, and the road to the financial market is still bumpy.

原刊於印尼《國際日報》及《香港印尼研究學社》,本社獲作者授權轉載。